Introduction

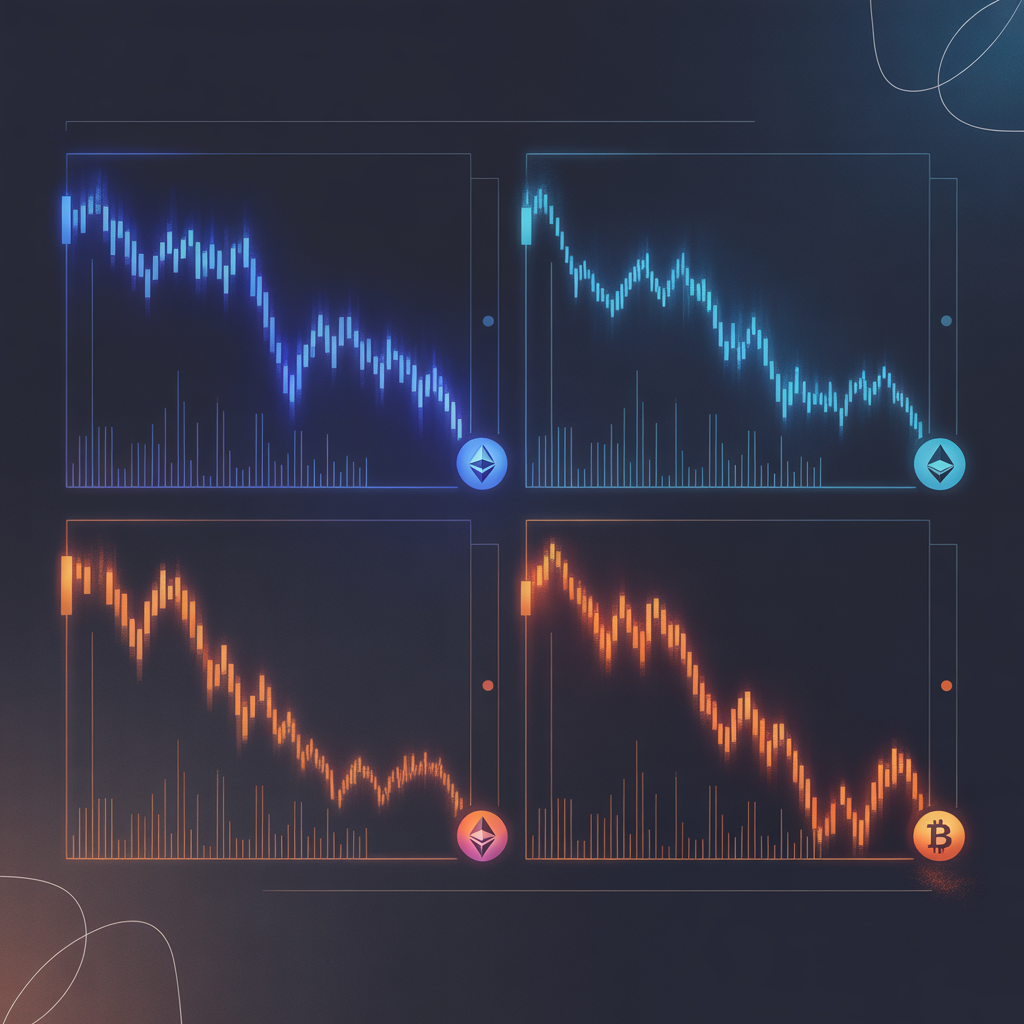

Crypto trading can feel confusing when you first start, especially with constant price changes. One of the most effective ways to understand market movement is by learning chart patterns. Chart patterns help traders see signals, predict possible price directions, and make smarter decisions. In this guide, we explain Mastering Crypto Chart Patterns: A Beginner’s Guide to Smart Trading in simple words so that anyone—beginner or intermediate—can understand how patterns work, why they appear, and how to use them in daily trading.

What Are Crypto Chart Patterns?

Chart patterns are shapes or repeating structures that appear on price charts. These patterns help traders understand whether buyers or sellers are stronger at a given time. When these shapes appear, they often suggest what may happen next—whether the price will go up, fall down, or move sideways. Learning to recognize chart patterns can turn random price movement into meaningful signals.

Why Chart Patterns Matter

Understanding chart patterns gives traders several important advantages:

- Predict Potential Trends: Patterns show early signs of breakouts, reversals, or continuation trends.

- Reduce Risk: Patterns help traders avoid emotional trading and instead base decisions on proven structures.

- Improve Timing: Chart patterns help in choosing better entry and exit points.

- Increase Confidence: With clear signals, traders feel more comfortable with their strategies.

These benefits make chart pattern knowledge one of the strongest tools for new crypto traders.

Types of Chart Patterns

Crypto chart patterns are usually divided into three categories:

1. Reversal Patterns

These patterns suggest the market might change direction.

- Head and Shoulders: A pattern that signals a potential drop after an upward trend.

- Inverse Head and Shoulders: Predicts a possible rise after a downtrend.

- Double Top and Double Bottom: Double top hints at a fall; double bottom suggests a rise.

2. Continuation Patterns

These patterns indicate that the trend will likely continue.

- Triangles (Ascending, Descending, Symmetrical): Show consolidation before a breakout.

- Flags and Pennants: Appear after a sharp move and signal the trend may continue.

- Rectangles: Represent price moving sideways before continuing the trend.

3. Neutral Patterns

These patterns show price indecision and can break either way.

- Wedges: Rising or falling wedges can lead to either continuation or reversal.

- Diamond Patterns: Can point to a breakout but direction is uncertain.

Recognizing these patterns helps traders react more effectively.

How to Read Chart Patterns Easily

Reading chart patterns does not require expert-level knowledge. A few simple steps can help:

- Observe Price Waves: Identify highs, lows, and overall direction.

- Look for Shapes: Compare the chart to common patterns like triangles or flags.

- Check Volume: Breakouts with strong volume are more reliable.

- Wait for Confirmation: Never trade based on a guess—wait for a clear breakout or breakdown.

With practice, spotting patterns becomes easier and faster.

Using Chart Patterns in Real Trading

Chart patterns are useful, but they should be applied carefully. Here’s how beginners can use them:

- Set Entry Points: Buy or sell only after confirmation.

- Set Stop-Loss: Protect your money in case the pattern fails.

- Set Target Levels: Patterns often suggest how far a price may move.

- Manage Emotions: Follow the pattern signals, not fear or excitement.

When used correctly, patterns can help you Mastering Crypto Chart Patterns: A Beginner’s Guide to Smart Trading with better results and less confusion.

Most Common Patterns Beginners Should Learn

Some patterns appear more often and are easy to identify:

- Ascending Triangle: Indicates potential upward breakout.

- Bull Flag: Shows a strong trend may continue.

- Double Bottom: A strong signal for an upward reversal.

- Descending Triangle: Often signals a downward breakout.

Starting with these patterns builds a strong foundation.

Mistakes Beginners Should Avoid

While chart patterns are helpful, new traders often make mistakes:

- Trading too early: Always wait for confirmation.

- Ignoring market news: Patterns are powerful, but news can change everything.

- No stop-loss: Never trade without protection.

- Over-trading: Not every small movement is a pattern.

- Using only one pattern: Combine patterns with indicators when possible.

Avoiding these mistakes leads to smarter and safer trading.

Combining Chart Patterns with Indicators

For stronger signals, traders often use indicators along with chart patterns:

- RSI (Relative Strength Index): Shows overbought or oversold conditions.

- MACD: Helps identify trend direction and momentum.

- Moving Averages: Show long-term and short-term trends.

Combining tools helps confirm the reliability of patterns.

Practice Makes Perfect

Like any skill, reading chart patterns becomes easier with practice. Beginners can start by analyzing historical charts, marking patterns, and testing strategies without risking money. Over time, patterns become clearer, and decision-making becomes smoother. Consistent practice leads to long-term success.

Conclusion

Chart patterns are powerful tools that help traders understand market behavior and make smarter decisions. They simplify the complex world of crypto trading by turning confusing price movements into easy-to-read signals. With patience, practice, and consistent learning, anyone can Mastering Crypto Chart Patterns: A Beginner’s Guide to Smart Trading and build a strong foundation for long-term success in the crypto market.

FAQs

People often ask which chart pattern is easiest for beginners, and many traders start with triangles and double bottoms because they are simple to spot; others ask if chart patterns always work, and the truth is no pattern is perfect, but they offer strong clues when combined with confirmation signals; some wonder whether chart patterns can be used for short-term trading, and yes, many patterns work well on smaller timeframes like 15-minute or 1-hour charts; another common question is whether beginners should rely only on patterns, and experts recommend combining them with indicators such as RSI or moving averages; finally, people ask how long it takes to master patterns, and while it varies, consistent practice and reviewing past charts help traders improve much faster.